In a truly bizarre turn of events, 56 Chinese hotels asked to have their five-star ratings downgraded last year. Meanwhile, an untold number of four-star establishments stalled planned improvements to skirt a potential ratings upgrade, according to state-run Xinhua. This newfound aversion to the Chinese National Tourism Administration’s (CNTA) top ranking has come by way of a government ban on party officials splurging money at five-star establishments, and is just one of a series of measures aimed at curbing Chinese excess.

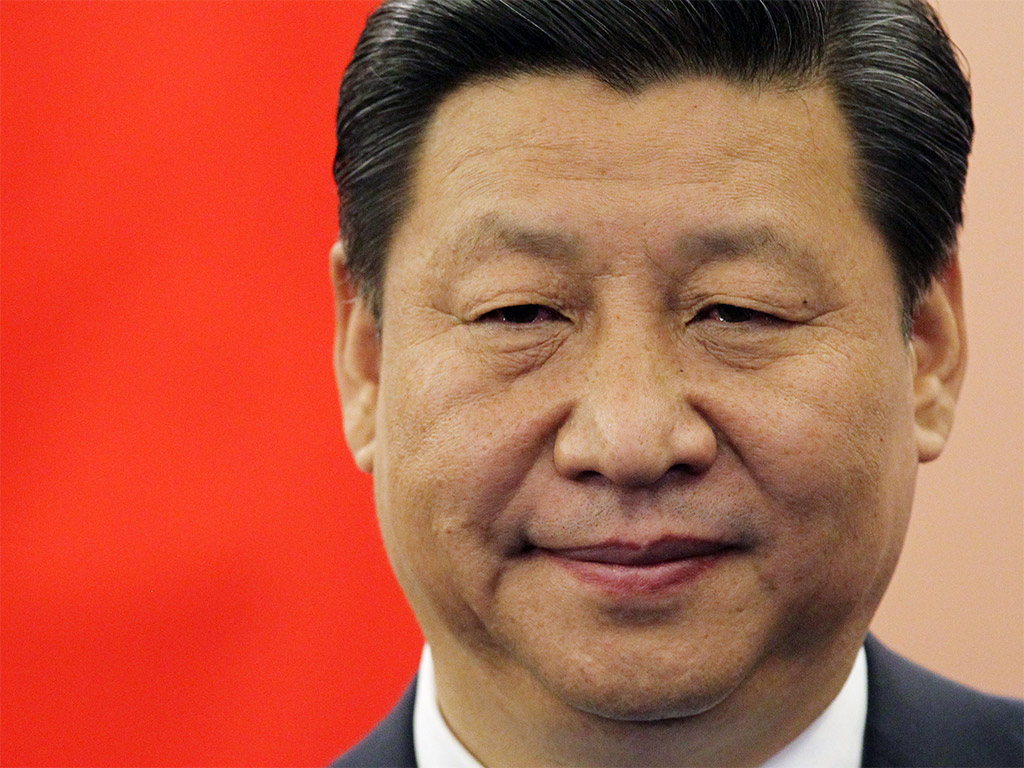

Whereas once the five-star rating was a guarantee of turning profit, the rule of President Xi Jinping has coincided with a clampdown on lavish spending and an emphasis on frugality, effectively changing the complexion of China’s tourism industry.

Owing to China’s recent tourism boom, the mainland hosts more than 4,000 starred hotels, 680 of which have qualified for the CNTA top rating. What’s more, the population’s insatiable appetite for travel has expanded to such a degree that it became the world’s biggest tourism spender last year, with new hotels being built at a rate unseen in the developed world.

Key industry players have gone to great lengths to ensure they get in on the action, with Starwood, InterContinental Hotels Group and Hilton all bringing their brands to mainland markets. Hilton ended 2012 with 34 Chinese properties – a sizeable increase on the four it had there only four years previous.

[G]rowth is slowing and tourist numbers are on the decline

Hotel industry declines

Market research conducted by IBIS World puts the hotel industry’s annual growth rate at an impressive average of 9.3 percent in the five years preceding 2014. But now growth is slowing and tourist numbers are on the decline.

According to Chen Miaolin, Vice President of the China Tourism Association and the man who broke news of the five-star downgrades, the industry suffered a 25 percent revenue decline last year and some 20 hotels were forced to close every month. On the other hand, the China Tourist Hotel Association states that a new international-brand hotel is built every four days.

Despite conflicting reports of hotel numbers, what’s certain is that the rate of supply far outstrips that of demand, and many in the luxury hotel industry have fallen foul of dwindling occupancy rates. According to STR Global, while demand for luxury accommodation increased by four percent, supply was up 7.4 percent.

Occupancy rates at China’s five-star hotels came in at 57.6 percent last year, far short of that in neighbouring South East Asian nations and the 70 percent industry standard – the rate at which five-star hotels break even. In the past, high-end hotels could operate at a loss by taking advantage of concessions granted by local government, who saw five-star establishments as a way to boost renown. Last year this corrupt system was brought to an end.

Regardless of the downturn, hotel operators, international groups in particular, have been reluctant to halt expansion plans. That is, until the austerity drive and clampdown on corruption really took hold at the end of 2012.

Luxury sector suffers

Chen has attributed the slowdown in the luxury hotel sector, at least in part, to the government ban on five-star spending, and he admits that New Century Tourism Group, of which he is chairman, has been forced to rethink its business strategy to weather the changes.

Overall, the group experienced an 18 percent decline in revenue across its portfolio of 64 properties last year, which includes 40 five-star establishments. Its government business has shrunk to less than three percent of catering revenue, as opposed to 15 percent prior to the clampdown.

The hotel industry is not alone in suffering at the hands of austerity, however, with the same effects extending to the whole luxury sector. Coinciding with declines in the hotel industry is a 25 percent fall in gift-giving through 2013 – another consequence of Beijing’s anti-corruption measures.

Extraordinary circumstances

While China surpassed America as the largest market for luxury consumption in 2012, and has since grown to account for 29 percent of the market, according to Bains and Co, luxury goods are now seen as a symbol of China’s widening disparity between rich and poor.

Therefore, at the close of 2012 came a government plan to discourage excessive spending, ban the luxury goods advertising on state-run media, and bump up taxes on the purchase of high-end products and services. As a consequence, luxury spending experienced its third consecutive year of decline last year, and fell by 15 percent in 2013 on an annualised basis, according to Hurun Report.

The unusual solution for hotels may well be to get rid of their up-market reputations if they are to stay afloat. In an industry characterised by low occupancy rates and over-competition, hotel operators can ill afford to do away with a line of business that has long constituted a considerable chunk of their customer base.

However, it may also be the case that China’s luxury hotel industry is in the midst of a wholesale structural change, as it ends its reliance on government officials and begins to capitalise instead on an influx of international and domestic tourists.