Russia’s significance to the global financial market is indisputable. In its 2010 list of the wealthiest nations according to nominal Gross Domestic Product, the International Monetary Fund ranked the Russian Federation in eleventh place. The Fund also places Russia in sixth place in terms of its GDP as derived from purchasing power parity calculations of the same year. Furthermore, with its possession of the world’s largest natural gas reserves, second largest oil reserves and status as the world’s third largest electricity producer, Russia’s future as a leading energy superpower appears inevitable.

Transcending borders

“Russia will not soon become, if it ever becomes, a second copy of the United States or England, where liberal values have deep historic roots.” Vladimir Putin, Prime Minister, Russian Federation.

Both geographically and politically, Russia’s placement on the world stage is characterised by its concomitant – and often conflicting – connection to both the West and the East. Its staggering scope, which boasts borders with no less than fifteen separate nations, including China, North Korea, Poland and a maritime border with the United States of America, enables the world’s largest country to form alliances with both developed and developing nations, subsequently fostering camaraderie as well as distrust from its international partners.

Needless to say, throughout much of modern history, the West has been sceptical with regard to where Russia’s true loyalties lie. Is Russia best characterised by its involvement in The Council of Europe and the Organisation for Security and Cooperation in Europe? Or is it best defined by its leading role in bodies such as the Asia-Pacific Economic Cooperation and the Eurasian Economic Community?

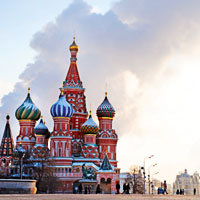

The truth is that Russia itself does not think in terms of such binaries and that its only concrete political leaning is towards itself; towards the fostering of its own strength. Its affiliation with the ‘East’, notable in its appropriation of Orthodox Christianity from the Byzantine Empire, and links to the ‘West’, which were most notably fostered by Tsar Peter the Great and are still visually evident in the prevalence of Baroque and neo-classical architecture of St Petersburg, are not oppositional.

With increasing travel and trade outside its boundaries, Russia has appropriated elements of the cultures surrounding it, yet, nevertheless, remains an entity unto itself. Even as far back as 1829, philosopher Petr Chaadaev noted that “we (Russians) are neither of the West nor of the East, and we have not the traditions of either. We stand, as it were, outside of time, the universal education of mankind has not touched us.”

Despite its clear decline in political influence since the end of the Cold War and the dissolution of the Soviet Union in 1991, recent economic and diplomatic developments have alerted the international community of Russia’s possible re-emergence as a ‘superpower’.

Yet, with an unsustainable economic policy on tax and continuing subversion of its legal processes for the furtherance of political motivations – which both suggest that the strength of the Russian government, rather than the business success of its industries, is the main goal of the modern Russian Federation.

Russia: The ‘new’ superpower

Within the context of a global economy that can be characterised by its increasing dependence upon oil, Russia’s standing as the world’s largest oil producer should certainly signal to the international community that the Federation’s influence in global markets – as well as, subsequently, in political terms – will undoubtedly increase over the next few years. In short, we underestimate the Russian Federation at our peril. In this light, the UK would indeed be wise to at least partially predicate its continuing economic recovery on the relatively flourishing Russian commodities-based economy. So why are so many UK businesses failing to either create or solidify their bonds with Russian companies through trade and development opportunities?

It would seem that the answer lies in Russia’s indiscriminate and thus often contradictory approach to creating alliances worldwide. That is, the Federation has removed the shackles of its Soviet-era isolationism so fast that its diplomatic prowess has yet, it appears, to catch up. Most recently, for example, Russia’s new oil agreement with Japan has, by inflaming old rivalries, fostered distrust from trade partner China. Moreover, the economic necessity to forge business alliances with the Russian Federation is often, for UK and other Western governments and companies, at odds with the latter’s knowledge of Russia’s record of unethical business practices and human rights violations. This is most clearly symbolised by the continuing imprisonment of former oil tycoon Mikhail Khodorkovsky, which most commentators outside of Russia agree to be unlawful and acts as a reminder of the uncomfortable nature of the foundation upon which Russia’s oil industry has thrived.

Oil

As BP’s World Energy Statistical Review for 2010 suggests, global economic growth and the sphere of energy supply and demand are more critically intertwined now – in the aftermath of the global economic downturn – than during the last thirty years. Demand for energy grew by 5.5 per cent from 2009 – the largest annual increase in more than three decades. Furthermore, as oil accounts for more than a third of all global energy produced last year and as global oil demand is expected to rise by 1.4-1.6 percent this year, this seemingly-insatiable international appetite for fuel resources clearly translates into a greater necessity to trade – and subsequently also to ally itself – with Russia.

China – the world’s largest consumer – has been quick to adapt itself to Russia’s post-1991 economic transformation, securing a lucrative oil trade agreement with the country; one that has enabled Russian state-owned oil company Transneft, which manages the project, and Rosneft to obtain a loan worth $25 billion for further pipeline and oil fields development. Pivotally, the East Siberia-Pacific Ocean oil pipeline that physically (and thus also politico-economically) connects the two countries marks the emergence of a strong political alliance, especially considering China’s position as the second largest economy in the world after the US.

Commenting on the pipeline – which began operating in January of this year and is expected to export 15 million tonnes of oil each year during the next two decades – Russian Prime Minister Vladimir Putin stated that the venture would help Russia diversify its exports. Clearly, Russia is in the mood for business expansion. Whether or not Western nations will endeavour to either challenge or annex themselves to this new power coupling and whether Russia’s position as an ‘energy superpower’ will continue, however, remains to be seen.

The now collapsed joint BP and Rosneft Arctic venture can be seen as the most recent example of the UK’s acknowledgement of both the oil industry’s and Russia’s significance in its economic recovery. The deal, which was signed in January and then dismantled in May of this year, would have seen BP gain a foothold in Russia’s three offshore Arctic Kara Sea oilfields. Ultimately, the UK-based company’s endeavour was blocked by the Alfa Access Renova consortium, the shareholder of its Russia-based subsidiary TNK-BP, which already has a competitive position in the Arctic region, due to the latter’s insistence that the terms of its ‘involvement’ in the project (a $32bn offer including $9bn in BP stock) would not provide enough of a return to merit the alleged conflict of interests. However – typifying the changeability that currently characterises the European economy – whilst the collapse of the BP-Rosneft deal was understood as a disappointment for the UK-based company as recently as May, current complications in Russia’s innovations within its oil industry suggest that triumphing the Federation as an economic world leader would be premature.

The Centre of Global Energy Studies expects Russia’s oil production to continue to show only modest growth for the rest of the year. Whilst aggregate output is anticipated to increase by 170,000 bpd (1.7 per cent) on an annual average basis this year, setting a new post-Soviet record of 10.26 mbpd, exports via pipeline monopoly Transneft fell by 5.9 percent to 3.97 million bpd from 4.22 million bpd in May. Moreover, according to data disclosed by the Russian Energy Ministry, Russian oil production stood at 10.195 million barrels per day in June, down from 10.26 million barrels per day in May.

Most worryingly, however, Russian Prime Minister Vladimir Putin has said that the country will need over 8.6 trillion roubles ($308.7bn) to keep pumping oil at current levels until 2020, while the Energy Ministry has warned output could fall by 20 percent without substantial financing. According to International Energy Agency senior oil market analyst Julius Walker, despite Russia’s increase in annual oil output this year, “clearly, Russia’s production growth is not catching up with the world’s growing demand. Russia’s mature fields base is so large that it needs a lot of new projects just to offset that decline, so any changes to the tax regime would have to be ones that encourage significant new fields start-ups.”

According to Reuters’ Moscow correspondent Vladimir Soldatkin, it is the heavy tax burden on Russian companies that will render the nation unable to sustain its oil-based economic growth and thus fail to secure much-needed international investment. Currently, Russian oil companies pay 78 percent of total company profits in tax to the government, which makes investment into growth opportunities particularly hard. It would seem that its own internal infrastructure denies Russia the opportunity to truly be a leader on the world stage. Clearly, then, Russia needs foreign investment as much as, if not more than, the international community needs to annex itself to Russia’s energy-centric economy.

Ethical considerations

“Russia needs a strong state power and must have it, but I am not calling for totalitarianism.” – Putin

It is once again the issue of tax that proved the catalyst of one of the most widely-reported political scandals in Russia’s post-Soviet history. The imprisonment of former businessman Mikhail Khodorkovsky, whose Yukos oil empire, following its takeover of Sibneft in 2003, produced more oil than Qatar, is indicative of the ruthlessness of Putin and now Medvedev’s business governance: it is the strength of the Russian government and not the power of its oligarchs that will determine its fate now.

It is widely accepted that most of Russia’s billionaires made money after the collapse of the USSR through illegitimate means and it has also been documented that the main reason why Putin prosecuted Khodorkovsky rather than some other Russian businessmen else is not so much due to his alleged tax evasion, but his political strength and subsequent position as a threat to the hegemony of the Putin-headed government.

Taming the tycoons

In December of last year, whereby Khodorkovsky, in his second trial, was found guilty of stealing 350 million metric tons of oil worth $30 billion from a company that he controlled, US Secretary of State Hillary Clinton spoke out about the covert political and business motivations behind the continuing imprisonment of the former oil tycoon, noting that the case raises serious questions about selective prosecutions and about the rule of the law being overshadowed by political considerations. It is noteworthy that following Khodorkovsky’s incarceration, the Russian government systematically dismantled Yukos and enabled the majority of the latter’s assets to be integrated into state-owned Rosneft.

With a population of 143 million, clearly Russia is not averse to sacrificing some individuals in the fight to attain wealth and strength in both the domestic and international sphere. Yukos’ covert nationalisation was dependent upon the removal of Khodorkovsky, much as the Bolshevik revolution was dependent upon the murder of the Tsar and the continuation of the partial state-control of the media was somewhat dependent on the murder of journalist Anna Politkovskaya.

Nevertheless, despite the uncomfortable nature of Russian hegemonic policies towards its citizens and rivals and the still-elusive prospect of Russia’s domestic economy, the Federation’s continuing importance in the global energy market suggests that foreign businesses and governments must prepare themselves – cautiously – to engage in business and political alliances with Russia if they hope to secure their economic advancement. After all, even if it is China rather than Russia that merits the term ‘superpower’, the current economic interdependence of the two will enable both parties to prosper politically on the world stage. The future of Russia thus rests in its cooperation with the international community. The latter would be wise to utilise this.